Access Exclusive Value Creation Opportunity by Investing in Healthcare Venture Capital Investor Team Focused on Next Generation Artificial Intelligence & Machine Learning

Dev Sharma (MBA, UChicago Booth) *[email protected]u

Dev Sharma (MBA, UChicago Booth) *[email protected]u

Firm Overview

DigitalDx Ventures is an early-stage, majority woman-owned impact fund comprised of a team of successful Silicon Valley digital health investors and medical professionals leveraging AI and big data technologies to diagnose major global health issues (such as breast and other cancers, cardiovascular and kidney health, Alzheimer’s, and mental health) with a particular focus on:

Additionally, DigitalDx Ventures provides an excellent opportunity to invest behind a manager promoting several of the United Nations Sustainable Development Goals (“SDGs”), most notably Good Health & Well Being and Gender Equality.

Team Background

Collectively, the DigitalDx Ventures team has invested (directly or through previously managed funds) in over a dozen companies and the Partners have close to 200 patents to their credit.

The fund partners have deep ties to Stanford, UCSF, major medical institutions for clinical testing, startup communities, and the women entrepreneurship community; and all partners participate and judge competitions for organizations such as SPADA, StartX, and UCSF Incubator.

Michele Colucci, Esq. - Co-Founder & Managing Partner/CEO

Ted Driscoll, PhD - Co-Founder & Partner Emeritus

Eric Weiss, MD - Venture Partner & Chief Medical Officer

David B. Kirk, PhD - Venture Partner & Artificial Intelligence Specialist

Gianna Conci Orozco - Director of Finance

Macro Industry: Venture Capital Activity within Artificial Intelligence / Machine Learning (1)

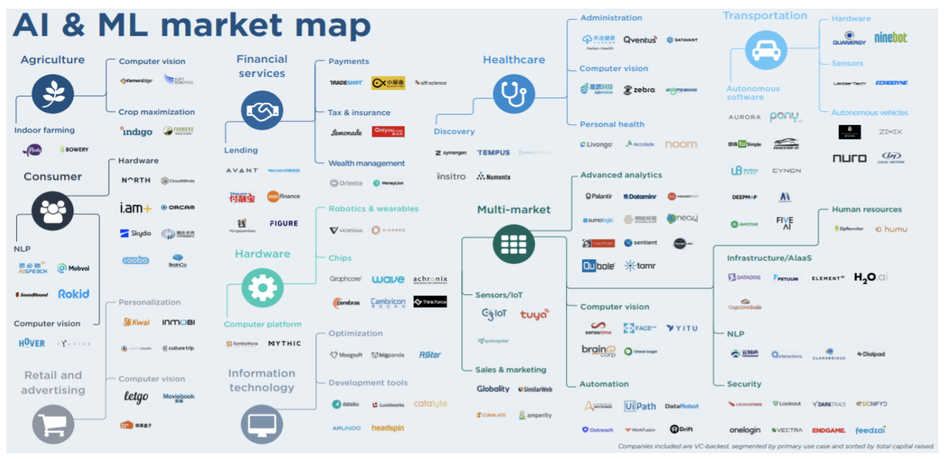

Artificial intelligence (AI) is the area of computer science that focuses on creating intelligent machines that can perceive their environment and make decisions to maximize the chances of reaching their goals. Machine learning (ML) is a subfield of AI that aims to give computers the ability to learn iteratively, improve predictive models and find insights from data without being explicitly programmed.

AI & ML technology could conceivably imitate the utility and ubiquity of the internet as a tool in transforming business—a potential that translates into an exceedingly large addressable market. Spending on AI & ML technologies is not only sizable—on track to reach $36 billion in 2019, according to IDC—but is also growing at a rapid clip with an estimated CAGR of 38% from 2018-2022.

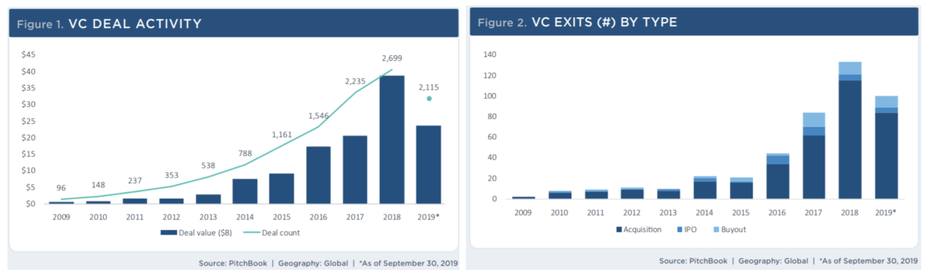

The growth of artificial intelligence technologies has been matched with venture capital interest within the space as both deal activity and exits have grown rapidly since 2009.

DigitalDx Ventures is an early-stage, majority woman-owned impact fund comprised of a team of successful Silicon Valley digital health investors and medical professionals leveraging AI and big data technologies to diagnose major global health issues (such as breast and other cancers, cardiovascular and kidney health, Alzheimer’s, and mental health) with a particular focus on:

- Enabling early, more accurate detection

- Minimizing invasiveness

- Expanding access to treatment through lowered costs

Additionally, DigitalDx Ventures provides an excellent opportunity to invest behind a manager promoting several of the United Nations Sustainable Development Goals (“SDGs”), most notably Good Health & Well Being and Gender Equality.

Team Background

Collectively, the DigitalDx Ventures team has invested (directly or through previously managed funds) in over a dozen companies and the Partners have close to 200 patents to their credit.

The fund partners have deep ties to Stanford, UCSF, major medical institutions for clinical testing, startup communities, and the women entrepreneurship community; and all partners participate and judge competitions for organizations such as SPADA, StartX, and UCSF Incubator.

Michele Colucci, Esq. - Co-Founder & Managing Partner/CEO

- JD Georgetown Law, BA Georgetown, MFA, AFI

- Serial entrepreneur; Lawyer, Silicon Valley Woman of Influence; Nobel Laureate Foundation Ambassador

Ted Driscoll, PhD - Co-Founder & Partner Emeritus

- PhD Stanford, MA/MIA Harvard, BA UPenn

- Spun out of former venture fund to start DigitalDx; top-tier track record; 90+ patents (e.g., iPhone fingerprint & underlying Google Street view tech); built first human MRI scanner

Eric Weiss, MD - Venture Partner & Chief Medical Officer

- MD UCSF, BS Stanford (Biological Sciences)

- Founder & CEO, The Village Doctor; Clinical Faculty, Stanford; Advisor/Board Member for the American Academy of Private Physicians

David B. Kirk, PhD - Venture Partner & Artificial Intelligence Specialist

- MS/PhD CalTech, BS/MS MIT (Mechanical Engineering)

- NVIDIA: Chief Scientist, VP Architecture, VP Research; National Academy of Engineering

Gianna Conci Orozco - Director of Finance

- B.S. Economics, Santa Clara University

- 15 years of venture capital experience; Claremont Creek Ventures; Rocketship.vc; Virgin Green Fund; Sierra Ventures; Ironwood Capital Management; Silver Lake Partners

Macro Industry: Venture Capital Activity within Artificial Intelligence / Machine Learning (1)

Artificial intelligence (AI) is the area of computer science that focuses on creating intelligent machines that can perceive their environment and make decisions to maximize the chances of reaching their goals. Machine learning (ML) is a subfield of AI that aims to give computers the ability to learn iteratively, improve predictive models and find insights from data without being explicitly programmed.

AI & ML technology could conceivably imitate the utility and ubiquity of the internet as a tool in transforming business—a potential that translates into an exceedingly large addressable market. Spending on AI & ML technologies is not only sizable—on track to reach $36 billion in 2019, according to IDC—but is also growing at a rapid clip with an estimated CAGR of 38% from 2018-2022.

The growth of artificial intelligence technologies has been matched with venture capital interest within the space as both deal activity and exits have grown rapidly since 2009.

The investment community continues to deploy capital within the space as all industries are currently undergoing a massive wave of transformation.

Healthcare Focus: Why AI in Healthcare? (1,2)

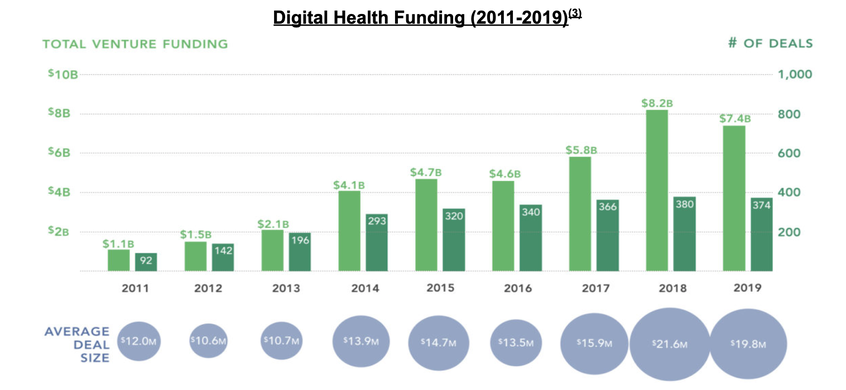

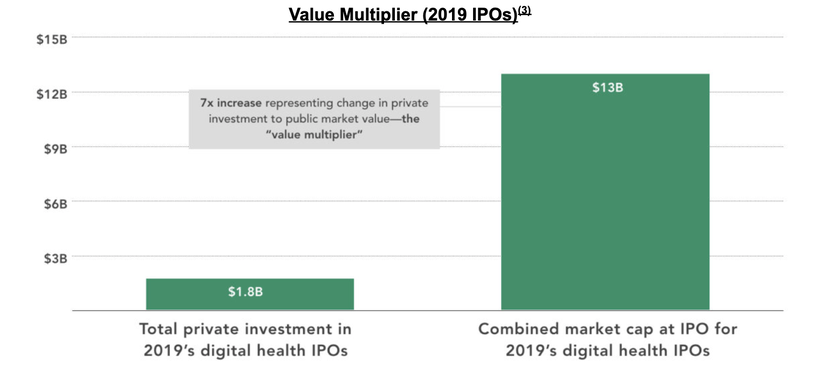

With healthcare costs representing ~18% of U.S. GDP, it is not surprising that this market attracts considerable investor interest. We believe widespread data digitization in healthcare provides a favorable backdrop for expanding implementations of AI & ML, which have the potential to transform many aspects of patient care, as well as administrative processes within provider, payer and pharmaceutical organizations. We are seeing the market appreciate this wave of digital healthcare as investment in the space has grown considerably in the last few years and there were six large digital health IPOs in 2019.

With healthcare costs representing ~18% of U.S. GDP, it is not surprising that this market attracts considerable investor interest. We believe widespread data digitization in healthcare provides a favorable backdrop for expanding implementations of AI & ML, which have the potential to transform many aspects of patient care, as well as administrative processes within provider, payer and pharmaceutical organizations. We are seeing the market appreciate this wave of digital healthcare as investment in the space has grown considerably in the last few years and there were six large digital health IPOs in 2019.

The six digital health companies that went public in 2019 (Livongo, Health Catalyst, Phreesia, Change Healthcare, Peloton, and Progyny) had a combined market cap of $17BN as of January 1, 2020. Excluding Change Healthcare as it was previously acquired by McKesson, these five companies converted private invested capital of $1.8BN to $13.0BN at IPO, generating tremendous wealth.

This trend of value creation within digital healthcare is in its early innings as the industry is expected to continue to grow led by applications of AI and ML, which is the core focus of DigitalDx Ventures.

Types of AI in Healthcare (2)

Artificial intelligence is not one technology, but rather a collection of them. Most of these technologies have immediate relevance to the healthcare field, but the specific processes and tasks they support vary widely. A few of the key types of artificial intelligence and their applications to healthcare are listed below:

Machine Learning - Neural Networks and Deep Learning

Natural Language Processing

Image Recognition / Process Automation

DigitalDx Portfolio

Working with a world-renowned expert on Artificial and Decision Intelligence, the DigitalDx team has internally developed an investment decision-making model called the Investment Tool for Expert Diagnostics (“iTED”) to capture relevant factors in evaluating potential investments, encourage greater adherence to key principles of successful outlier companies, and create discipline to aid in the consistency and scalability of analysis.

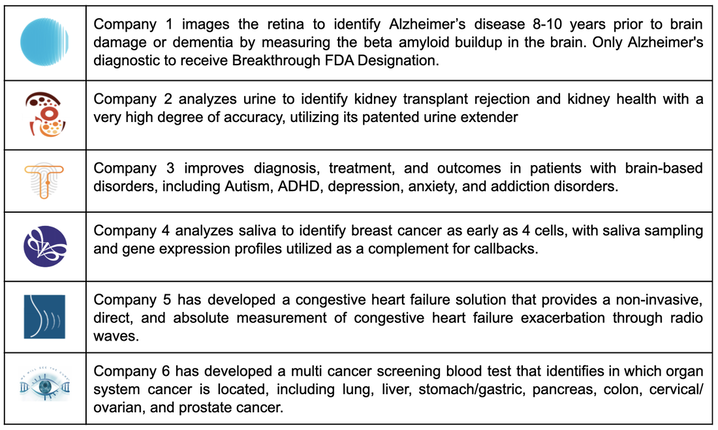

The DigitalDx team is uniquely qualified to source, diligence, invest, scale, and exit cutting-edge digital health companies and have thus far invested in six game changing investments:

Types of AI in Healthcare (2)

Artificial intelligence is not one technology, but rather a collection of them. Most of these technologies have immediate relevance to the healthcare field, but the specific processes and tasks they support vary widely. A few of the key types of artificial intelligence and their applications to healthcare are listed below:

Machine Learning - Neural Networks and Deep Learning

- Machine learning is a statistical technique for fitting models to data and to ‘learn’ by training models with data. Machine learning is one of the most common forms of AI; in a 2018 Deloitte survey of 1,100 US managers whose organisations were already pursuing AI, 63% of companies surveyed were employing machine learning in their businesses.

- In healthcare, the most common application of traditional machine learning is precision medicine – predicting what treatment protocols are likely to succeed on a patient based on various patient attributes and the treatment context. The great majority of machine learning and precision medicine applications require a training dataset for which the outcome variable (eg onset of disease) is known; this is called supervised learning.

Natural Language Processing

- This field, NLP, includes applications such as speech recognition, text analysis, translation and other goals related to language. There are two basic approaches to it: statistical and semantic NLP. Statistical NLP is based on machine learning (deep learning neural networks in particular) and has contributed to a recent increase in accuracy of recognition. It requires a large ‘corpus’ or body of language from which to learn.

- In healthcare, the dominant applications of NLP involve the creation, understanding and classification of clinical documentation and published research. NLP systems can analyse unstructured clinical notes on patients, prepare reports (eg on radiology examinations), transcribe patient interactions and conduct conversational AI.

Image Recognition / Process Automation

- This technology performs structured digital tasks for administrative purposes, i.e. those involving information systems, as if they were a human user following a script or rules. Compared to other forms of AI they are inexpensive, easy to program and transparent in their actions.

- In healthcare, many applications within diagnostics are based on radiological image analysis, though some involve other types of images such as retinal scanning or genomic-based precision medicine. Since these types of findings are based on statistically-based machine learning models, they are ushering in an era of evidence- and probability-based medicine.

DigitalDx Portfolio

Working with a world-renowned expert on Artificial and Decision Intelligence, the DigitalDx team has internally developed an investment decision-making model called the Investment Tool for Expert Diagnostics (“iTED”) to capture relevant factors in evaluating potential investments, encourage greater adherence to key principles of successful outlier companies, and create discipline to aid in the consistency and scalability of analysis.

The DigitalDx team is uniquely qualified to source, diligence, invest, scale, and exit cutting-edge digital health companies and have thus far invested in six game changing investments:

Track Record

Available Upon Request

Available Upon Request

Fund Terms

Available Upon Request

Given the target fund size and prior experience of the Partners, DigitalDx Ventures Fund I is an excellent fit for institutional players targeting healthcare, endowments, and high net-worth accredited investors.

For information on DigitalDx Ventures Fund I, please contact [email protected].

Available Upon Request

Given the target fund size and prior experience of the Partners, DigitalDx Ventures Fund I is an excellent fit for institutional players targeting healthcare, endowments, and high net-worth accredited investors.

For information on DigitalDx Ventures Fund I, please contact [email protected].

Sources:

(1) Pitchbook (3Q 2019 Emerging Tech Research - Artificial Intelligence and Machine Learning).

(2) National Center for Biotechnology Information. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6616181/

(3) Rock Health. https://rockhealth.com/reports/in-2019-digital-health-celebrated-six-ipos-as-venture-investment-edged-off-record-highs/.

(1) Pitchbook (3Q 2019 Emerging Tech Research - Artificial Intelligence and Machine Learning).

(2) National Center for Biotechnology Information. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6616181/

(3) Rock Health. https://rockhealth.com/reports/in-2019-digital-health-celebrated-six-ipos-as-venture-investment-edged-off-record-highs/.