What's Really Holding you Back? Small Endowments can Finally Invest in Early Stage Venture Capital

Michael Tellini (BA, Dartmouth College) *[email protected]

Michael Tellini (BA, Dartmouth College) *[email protected]

New developments in the asset class such as lower capital minimums and easier-than-ever fund manager diligence now enable small endowments to invest like Ivy League institutions and finally earn the same returns—or better.

I make the case that small endowments have been overlooking venture capital as an asset class because fund diligence and capital minimums are perceived as too difficult to meet. But due to the emergence of more small funds and first-time fund managers, smaller endowments can start to partake in returns previously only reserved for the largest institutions.

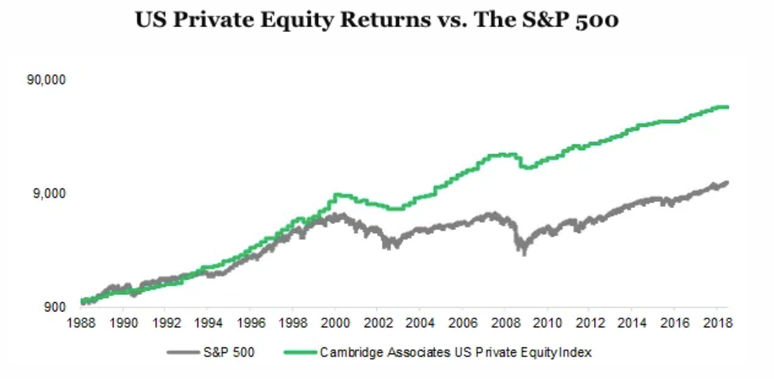

First, it’s important to establish the desirability of the investment. Private equity (including venture capital) has historically exhibited higher returns than other asset classes.

I make the case that small endowments have been overlooking venture capital as an asset class because fund diligence and capital minimums are perceived as too difficult to meet. But due to the emergence of more small funds and first-time fund managers, smaller endowments can start to partake in returns previously only reserved for the largest institutions.

First, it’s important to establish the desirability of the investment. Private equity (including venture capital) has historically exhibited higher returns than other asset classes.

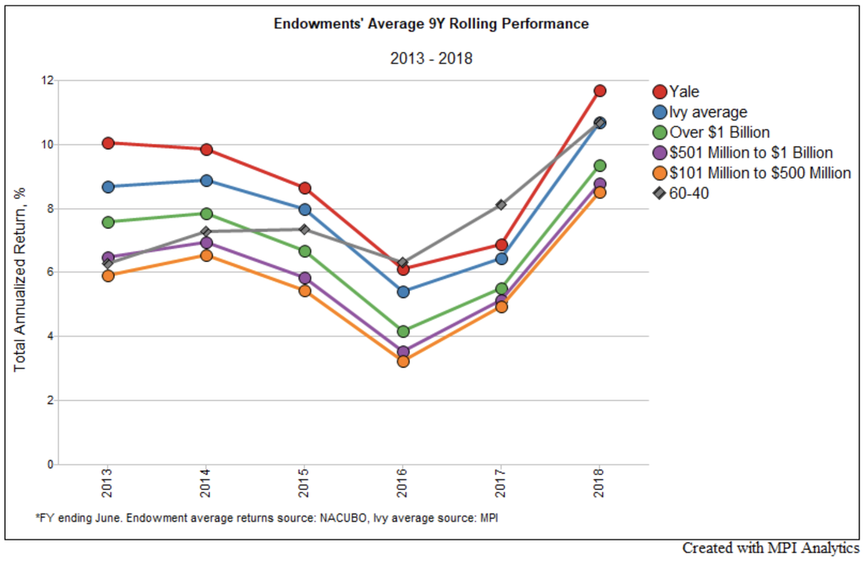

Mutual fund and hedge fund underperformance has been well-documented, but less attention has been paid to the higher returns in private equity/VC. An anonymous Ivy League endowment professional I spoke with said, “Theoretically, venture exhibits the highest returns among the conventional asset classes.” This sentiment is echoed by another Ivy League endowment manager—arguably the most successful CIO over the past few decades. David Swensen, Chief Investment Officer of Yale—who pioneered the approach of taking advantage of the illiquidity premium—has consistently allocated a higher portfolio share to venture and private equity. As a consequence, it’s no surprise that Yale has beaten out its peer institutions and the market average.

Seen in this graph, Yale has outperformed all sizes of endowments in average nine-year rolling performance. 60-40 refers to a market basket portfolio of 60% stocks and 40% bonds.

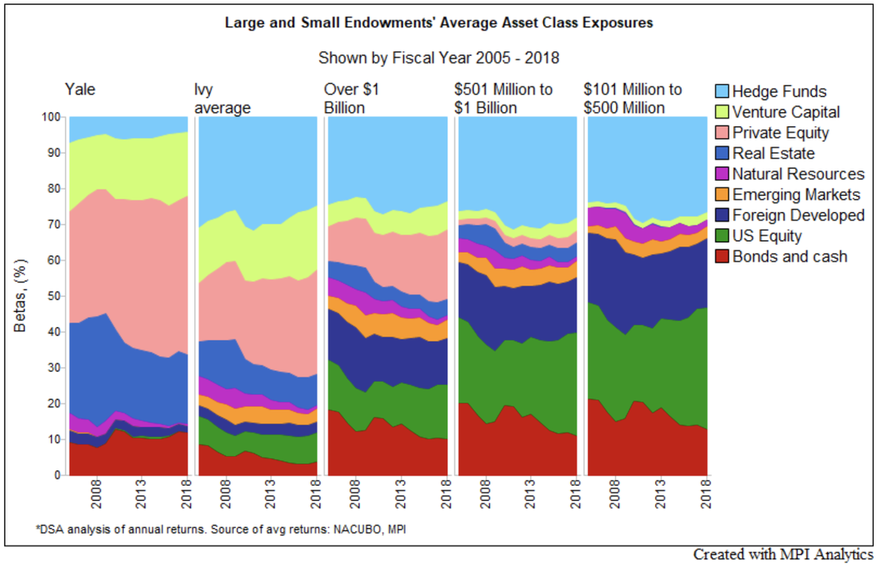

The exact breakdown of Yale’s portfolio compared to endowments of differing sizes provides some insight into Yale’s holdings (far left).

The exact breakdown of Yale’s portfolio compared to endowments of differing sizes provides some insight into Yale’s holdings (far left).

If you run a small endowment, you’re probably looking at these graphs and thinking that Yale’s approach differs from yours for three reasons:

1) Yale can better diligence fund managers

2) Fund capital minimums prevent you from investing in the asset class

3) Yale can get access to A-list fund managers

Let’s approach these concerns one at a time.

Fund diligence is easier than ever now given the order of magnitude increase in information sharing. Gathering references and information on a fund manager’s pedigree has been buoyed by tools such as LinkedIn, Burgiss, Pitchbook, and Preqin. Additionally, gathering information on portfolio performance is easier than ever thanks to new platforms like Carta. An uptick in funding, leading to more rounds and more frequent valuation updates, has also resulted in more information sharing between portfolio companies and VCs, making the historical returns VCs share with prospective LPs more meaningful. Investors participating in the second close of a fund also find it far easier to identify existing investors and to research their reputations through online search. This applies equally to fund investments if a fund already has existing investments. Indeed, information about the quality of co-investors is far more accessible and easily evaluated.

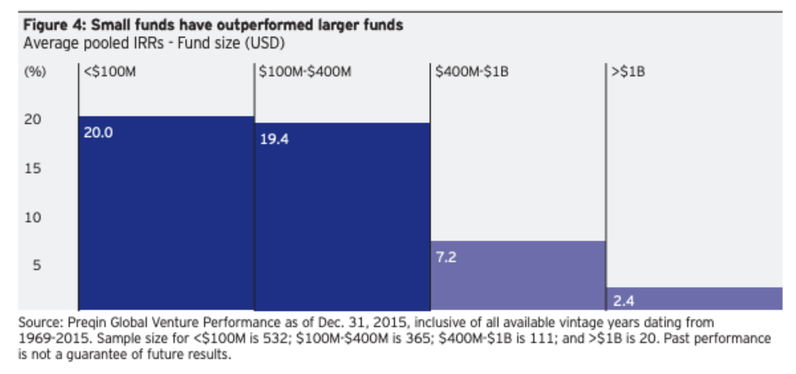

Capital minimums are no longer the obstacle they once were for small endowments for two main reasons. First, smaller funds have been on the rise, which often have miniscule capital minimums or no minimums at all. Without capital minimum requirements to get allocations in funds, small endowments can diversify across an array of small venture firms. Second, smaller funds also enable small endowments to gain an allocation in what one-day could become a large, successful, and difficult to enter fund. Adding icing to the cake, small funds exhibit better returns too.

1) Yale can better diligence fund managers

2) Fund capital minimums prevent you from investing in the asset class

3) Yale can get access to A-list fund managers

Let’s approach these concerns one at a time.

Fund diligence is easier than ever now given the order of magnitude increase in information sharing. Gathering references and information on a fund manager’s pedigree has been buoyed by tools such as LinkedIn, Burgiss, Pitchbook, and Preqin. Additionally, gathering information on portfolio performance is easier than ever thanks to new platforms like Carta. An uptick in funding, leading to more rounds and more frequent valuation updates, has also resulted in more information sharing between portfolio companies and VCs, making the historical returns VCs share with prospective LPs more meaningful. Investors participating in the second close of a fund also find it far easier to identify existing investors and to research their reputations through online search. This applies equally to fund investments if a fund already has existing investments. Indeed, information about the quality of co-investors is far more accessible and easily evaluated.

Capital minimums are no longer the obstacle they once were for small endowments for two main reasons. First, smaller funds have been on the rise, which often have miniscule capital minimums or no minimums at all. Without capital minimum requirements to get allocations in funds, small endowments can diversify across an array of small venture firms. Second, smaller funds also enable small endowments to gain an allocation in what one-day could become a large, successful, and difficult to enter fund. Adding icing to the cake, small funds exhibit better returns too.

Given small endowments have viewed capital minimums as obstacles to diversification in venture, the argument that the asset class is too risky for small endowments no longer holds. Said one anonymous small endowment manager, “Don’t underestimate the risk aversion of the small guys. Only part of my job is to make money; the main part is to not lose money.” Yet, small endowments have been allocating approximate 25% of their portfolio to hedge funds for the past decade (Preqin), suggesting that at least part of that amount could alternatively be invested in other illiquid assets. Endowments may especially want to reconsider their hedge fund allocation given that average venture fund IRRs have beaten hedge fund returns over the past decade. Diversification in venture capital is now easier than ever for small endowments, says Michele Colucci, managing partner at DigitalDx Ventures. She elaborates, "Due to COVID, many investment commitments for new fund managers have been put on hold so existing fund managers can be fully supported with additional capital where needed. This has created an opportunity for investment in new fund managers raising sub $100m funds who can and will accept smaller checks, and who statistically return more than larger funds. We have investments that are scaling fast so we've taken an aggressive bottoms up approach to fundraising which includes offering small endowments the opportunity to invest with benefits like no markup on existing investments giving investors an instant increase in value, and lowering fund minimums."

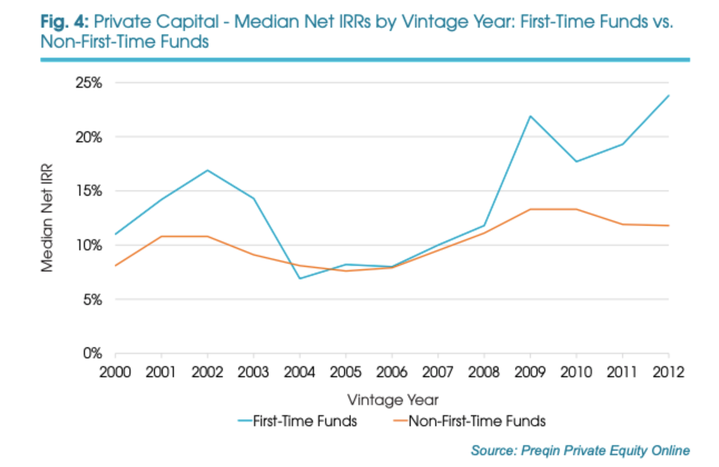

Access is also a frequently cited barrier to entry for small institutions. Without decades-long ties to A-list venture firms, how else are small endowments supposed to achieve the same returns? Interestingly, first-time private capital fund managers continually beat the industry benchmark, and the S&P 500. Naturally, the rise in new venture funds has coincided with a rise in first-time fund managers. Given first-time fund managers also tend to charge lower management fees, they pose a unique opportunity for small endowments. Large institutions can’t invest in first-time managers because they’d take up too large a percentage of the fund—and the check sizes aren’t worth their time—but small institutions can benefit from the outsized returns, assured that they’re properly diversified because of the already discussed changes in capital minimums.

Access is also a frequently cited barrier to entry for small institutions. Without decades-long ties to A-list venture firms, how else are small endowments supposed to achieve the same returns? Interestingly, first-time private capital fund managers continually beat the industry benchmark, and the S&P 500. Naturally, the rise in new venture funds has coincided with a rise in first-time fund managers. Given first-time fund managers also tend to charge lower management fees, they pose a unique opportunity for small endowments. Large institutions can’t invest in first-time managers because they’d take up too large a percentage of the fund—and the check sizes aren’t worth their time—but small institutions can benefit from the outsized returns, assured that they’re properly diversified because of the already discussed changes in capital minimums.

In sum, small endowments are already investing a quarter of their portfolio in illiquid assets such as hedge funds, so why not invest where the returns are higher?. We’ve seen that diligence, capital minimums, access, and diversification are no longer obstacles for small institutions. Said an anonymous endowment office professional, “If I were running a small endowment, would there be a place for early stage venture in my portfolio? Of course. So long as I could diversify across managers.”

As a bonus—and in the spirit of full disclosure—here’s a look at the early stage venture firm where I work as a fellow, DigitalDx Ventures.

Located in the heart of Silicon Valley on Sand-Hill Road, DigitalDx invests in healthcare-AI startups that solve some of the world’s most pressing problems diagnosing illness. We help doctors diagnose illness earlier, less invasively, less expensively and more accurately. We are doctors, lawyers, CEO's, venture capitalists and investors knowledgeable about all aspects of finding, nurturing, scaling and exiting our companies. Top-tier venture funds in the valley have relied on DigitalDx’s partners for years and the team is deeply connected to Stanford and UCSF, among other preeminent medical institutions across the country. Collectively, our Fund Partners have invested in over a dozen companies which today have a combined value of >$3 Billion.

The artificial intelligence space has seen continued growth in investment and exists, making it an attractive vertical for returns. Our Fund partners have had five exits at 5x to 40x multiples and collectively have over 60 issued patents to our credit. DigitalDx also places a priority on impact investing, tackling two of the United Nations’ sustainable development goals (SDGs) head on and investing in DigitalDx aligns institutional investors with their missions. Our portfolio companies strive to achieve the UN’s third goal by promoting “good health and well being” and the UN’s fifth goal by promoting “gender equality.” By investing in diagnostics, we promote less invasive solutions and early detection of illness. More than 50% of our portfolio companies have female founders or women in the C-suite and the fund is majority female owned and operated, checking many boxes for endowments wishing to increase their investment in women fund managers.

For information on DigitalDx Ventures Fund I, please contact [email protected]

As a bonus—and in the spirit of full disclosure—here’s a look at the early stage venture firm where I work as a fellow, DigitalDx Ventures.

Located in the heart of Silicon Valley on Sand-Hill Road, DigitalDx invests in healthcare-AI startups that solve some of the world’s most pressing problems diagnosing illness. We help doctors diagnose illness earlier, less invasively, less expensively and more accurately. We are doctors, lawyers, CEO's, venture capitalists and investors knowledgeable about all aspects of finding, nurturing, scaling and exiting our companies. Top-tier venture funds in the valley have relied on DigitalDx’s partners for years and the team is deeply connected to Stanford and UCSF, among other preeminent medical institutions across the country. Collectively, our Fund Partners have invested in over a dozen companies which today have a combined value of >$3 Billion.

The artificial intelligence space has seen continued growth in investment and exists, making it an attractive vertical for returns. Our Fund partners have had five exits at 5x to 40x multiples and collectively have over 60 issued patents to our credit. DigitalDx also places a priority on impact investing, tackling two of the United Nations’ sustainable development goals (SDGs) head on and investing in DigitalDx aligns institutional investors with their missions. Our portfolio companies strive to achieve the UN’s third goal by promoting “good health and well being” and the UN’s fifth goal by promoting “gender equality.” By investing in diagnostics, we promote less invasive solutions and early detection of illness. More than 50% of our portfolio companies have female founders or women in the C-suite and the fund is majority female owned and operated, checking many boxes for endowments wishing to increase their investment in women fund managers.

For information on DigitalDx Ventures Fund I, please contact [email protected]

Works Cited

Antal, Luke . “Venture Returns Outperform Public Markets Over Many Periods.” Alumni Ventures Group, December 18 2019, https://cdn2.hubspot.net/hubfs/3925488/_SoT_Mirror/04_White_Papers/Venture%20Returns%20Outperform%20Public%20Markets%20Over%20Many%20Periods.pdf

Glode, Vincent. “Why Mutual Funds ‘Underperform.’” Journal of Financial Economics, North-Holland, 17 Oct. 2010, www.sciencedirect.com/science/article/abs/pii/S0304405X10002448.

“Large and Small Endowment Performance and Risk.” Large and Small Endowment Performance and Risk | Markov Processes International, 31 July 2019, www.markovprocesses.com/blog/large-and-small-endowment-performance-and-risk/.

McClure, Ben. “Taking a Closer Look at Hedge Fund Returns.” Investopedia, February 28 2020, https://www.investopedia.com/articles/02/111302.asp

“Preqin Special Report: Making the Case for First-Time Funds.” Preqin.com, Preqin, Nov. 2016, docs.preqin.com/reports/Preqin-Special-Report-Making-the-Case-for-First-Time-Funds-November-2016.pdf.

Rabener, Nicolas. “Private Equity: The Emperor Has No Clothes.” CFA Institute Enterprising Investor, 19 Aug. 2019, blogs.cfainstitute.org/investor/2018/12/03/private-equity-the-emperor-has-no-clothes/.

Riquier, Andrea. “Hedge Funds Still Can't Keep up with the Stock Market.” MarketWatch, MarketWatch, 17 Oct. 2019, www.marketwatch.com/story/hedge-funds-still-cant-keep-up-with-the-stock-market-2019-10-15.

Rowley, Jason D. “There Are More VC Funds Than Ever, But Capital Concentrates At The Top.” Crunchbase News, Crunchbase News, 8 Mar. 2019, news.crunchbase.com/news/there-are-more-vc-funds-than-ever-but-capital-concentrates-at-the-top/.

Sharma, Dev. “New Venture Opportunity.” DigitalDx Ventures, May 2020, https://docs.google.com/document/d/1W4R-qKpCG4br-TptOpwgl0IEokR_nYpBSBs3Br0vrTk/edit

Sheth, Ananya. “Are University Endowments Using the VC Adequately in their Growth Strategy?” DigitalDx Ventures, May 2020, https://docs.google.com/document/d/1OTr5y9h3gM9_O7zCyj6JIjTRd2vWySnsFGavglW6yFs/edit

Solotke, Michael. “Are you Developing an Impact Strategy?” DigitalDx Ventures, May 2020, https://docs.google.com/document/d/1MBmeOpxe_Ro1bWH7teGA_VSFAwwJuaOkVv35nq0phaQ/edit#heading=h.d1p0s8xm9n5p

Antal, Luke . “Venture Returns Outperform Public Markets Over Many Periods.” Alumni Ventures Group, December 18 2019, https://cdn2.hubspot.net/hubfs/3925488/_SoT_Mirror/04_White_Papers/Venture%20Returns%20Outperform%20Public%20Markets%20Over%20Many%20Periods.pdf

Glode, Vincent. “Why Mutual Funds ‘Underperform.’” Journal of Financial Economics, North-Holland, 17 Oct. 2010, www.sciencedirect.com/science/article/abs/pii/S0304405X10002448.

“Large and Small Endowment Performance and Risk.” Large and Small Endowment Performance and Risk | Markov Processes International, 31 July 2019, www.markovprocesses.com/blog/large-and-small-endowment-performance-and-risk/.

McClure, Ben. “Taking a Closer Look at Hedge Fund Returns.” Investopedia, February 28 2020, https://www.investopedia.com/articles/02/111302.asp

“Preqin Special Report: Making the Case for First-Time Funds.” Preqin.com, Preqin, Nov. 2016, docs.preqin.com/reports/Preqin-Special-Report-Making-the-Case-for-First-Time-Funds-November-2016.pdf.

Rabener, Nicolas. “Private Equity: The Emperor Has No Clothes.” CFA Institute Enterprising Investor, 19 Aug. 2019, blogs.cfainstitute.org/investor/2018/12/03/private-equity-the-emperor-has-no-clothes/.

Riquier, Andrea. “Hedge Funds Still Can't Keep up with the Stock Market.” MarketWatch, MarketWatch, 17 Oct. 2019, www.marketwatch.com/story/hedge-funds-still-cant-keep-up-with-the-stock-market-2019-10-15.

Rowley, Jason D. “There Are More VC Funds Than Ever, But Capital Concentrates At The Top.” Crunchbase News, Crunchbase News, 8 Mar. 2019, news.crunchbase.com/news/there-are-more-vc-funds-than-ever-but-capital-concentrates-at-the-top/.

Sharma, Dev. “New Venture Opportunity.” DigitalDx Ventures, May 2020, https://docs.google.com/document/d/1W4R-qKpCG4br-TptOpwgl0IEokR_nYpBSBs3Br0vrTk/edit

Sheth, Ananya. “Are University Endowments Using the VC Adequately in their Growth Strategy?” DigitalDx Ventures, May 2020, https://docs.google.com/document/d/1OTr5y9h3gM9_O7zCyj6JIjTRd2vWySnsFGavglW6yFs/edit

Solotke, Michael. “Are you Developing an Impact Strategy?” DigitalDx Ventures, May 2020, https://docs.google.com/document/d/1MBmeOpxe_Ro1bWH7teGA_VSFAwwJuaOkVv35nq0phaQ/edit#heading=h.d1p0s8xm9n5p