Calling AI, Health Tech, and Healthcare Leaders to Transform Healthcare through Investing in Early Stage Venture Capital!

Dariush Sarrafzadeh (MBA, UC Berkeley HAAS) *[email protected]u

Dariush Sarrafzadeh (MBA, UC Berkeley HAAS) *[email protected]u

Why successful health tech startup founders, AI startup founders as well as executives of healthcare companies should invest in health tech-AI focused early stage venture capital funds.

Founding teams of successful health tech startups and AI startups have transformed industries through developing and offering innovative products, services, and data harnessing tools. Innovative executives in healthcare across the globe are continuously launching new initiatives to modernize healthcare with goals such as increasing access to care, lowering costs, and improving patient care. Yet many of these founders and executives can also deploy their own capital to transform healthcare through investing in VC funds that focus on health tech startups, while receiving a financial return higher than that of other asset classes. Furthermore, these experts in the fields of AI, healthcare, and health tech can utilize their experiences and knowledge to advise their selected VC fund’s portfolio companies. Providing these advisory services will increase a portfolio company’s chances of growth and success, which could result in higher financial returns.

Founding teams of successful health tech startups and AI startups have transformed industries through developing and offering innovative products, services, and data harnessing tools. Innovative executives in healthcare across the globe are continuously launching new initiatives to modernize healthcare with goals such as increasing access to care, lowering costs, and improving patient care. Yet many of these founders and executives can also deploy their own capital to transform healthcare through investing in VC funds that focus on health tech startups, while receiving a financial return higher than that of other asset classes. Furthermore, these experts in the fields of AI, healthcare, and health tech can utilize their experiences and knowledge to advise their selected VC fund’s portfolio companies. Providing these advisory services will increase a portfolio company’s chances of growth and success, which could result in higher financial returns.

AI at the Center of Health Tech Innovation and Investment

Technology is seen by many as a solution to help combat issues with healthcare such as escalating healthcare costs and lack of access. Changes in regulations and new legislation are serving as drivers for increased innovation and investment in health tech. This includes the Patient Protection and Affordable Care act which includes policy that incentivizes value-based care rather than a volume-based model, and the CHRONIC Care Act which permits the funding of telehealth services for those covered by Medicare. Universities which have historically been at the forefront of innovation have created cross-disciplinary centers to foster collaboration among engineers, computer scientists, clinicians, biomedical researchers, and information technologists such as the UCLA Center for Systematic, Measurable, Actionable, Resilient and Technology-driven Health (aka Center for SMART Health)(1). While, investment management firms have been attracted to the space due to the incredible size of the market opportunity, with the CMS predicting national health spending to grow at an average annual rate of 5.4 percent for 2019-28(2). Therefore, reaching $6.8 trillion in 2028. M&A activity in the health tech space and valuations have been trending upwards consistently illustrating increasing appetite for health tech companies. In 2019 the trailing 30-month median EV/EBITDA multiple reached a new high of 17.9x(3).

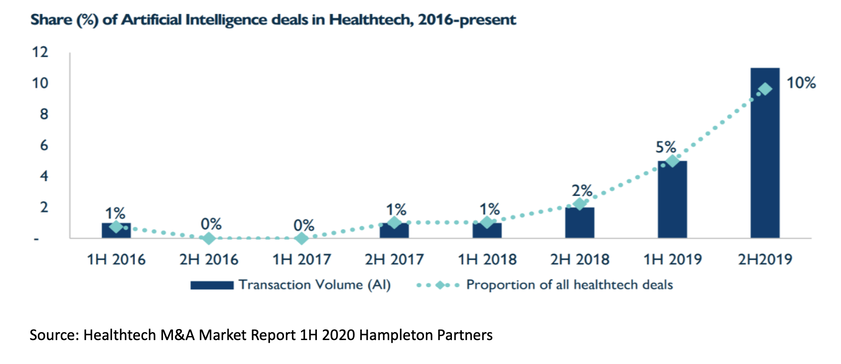

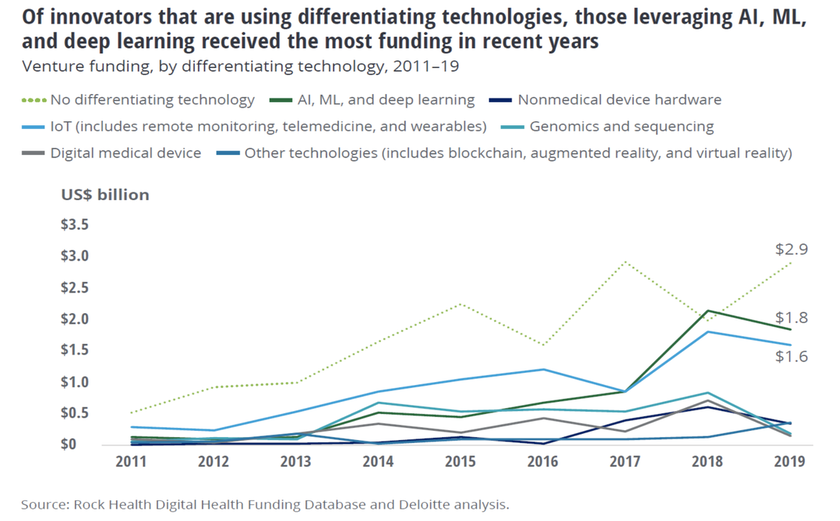

In recent years, innovative emerging health technologies that leverage AI, ML and deep learning have been catching the most attention from venture funds and brought with them exponential growth in deal activity. The number of AI-related health tech transactions has doubled every six months between the second half of 2017 and the end of 2019(3). Furthermore, total investments in AI related health tech following a compound annual growth rate of 40% since 2014 is expected to reach $6.6B by 2021(4). Even with the global COVID-19 pandemic, this expectation might still be met as in Q1 of 2020 health tech-AI startups raised $984M in equity funding across 80 deals(5). Why is AI getting so much attention in health tech? The increasing sophistication of AI allows it to do things more efficiently, faster, and cheaper. Things are already changing with better data driven decision making, more accurate diagnostic tools and medical devices retrieving and processing real time data. The practice of Medicine has changed dramatically in the past twenty years. Doctors have gone from not having enough data on a patient, to far too much data to understand. They need tools to help them to process massive amounts of data humans are incapable of processing and to retrieve data from sources they could not previously. These data tools are enabling startups to add value in ways traditional care providers have not. We are seeing the importance of these tools now as Mount Sinai researchers use AI to evaluate patients with COVID-19(6).

Technology is seen by many as a solution to help combat issues with healthcare such as escalating healthcare costs and lack of access. Changes in regulations and new legislation are serving as drivers for increased innovation and investment in health tech. This includes the Patient Protection and Affordable Care act which includes policy that incentivizes value-based care rather than a volume-based model, and the CHRONIC Care Act which permits the funding of telehealth services for those covered by Medicare. Universities which have historically been at the forefront of innovation have created cross-disciplinary centers to foster collaboration among engineers, computer scientists, clinicians, biomedical researchers, and information technologists such as the UCLA Center for Systematic, Measurable, Actionable, Resilient and Technology-driven Health (aka Center for SMART Health)(1). While, investment management firms have been attracted to the space due to the incredible size of the market opportunity, with the CMS predicting national health spending to grow at an average annual rate of 5.4 percent for 2019-28(2). Therefore, reaching $6.8 trillion in 2028. M&A activity in the health tech space and valuations have been trending upwards consistently illustrating increasing appetite for health tech companies. In 2019 the trailing 30-month median EV/EBITDA multiple reached a new high of 17.9x(3).

In recent years, innovative emerging health technologies that leverage AI, ML and deep learning have been catching the most attention from venture funds and brought with them exponential growth in deal activity. The number of AI-related health tech transactions has doubled every six months between the second half of 2017 and the end of 2019(3). Furthermore, total investments in AI related health tech following a compound annual growth rate of 40% since 2014 is expected to reach $6.6B by 2021(4). Even with the global COVID-19 pandemic, this expectation might still be met as in Q1 of 2020 health tech-AI startups raised $984M in equity funding across 80 deals(5). Why is AI getting so much attention in health tech? The increasing sophistication of AI allows it to do things more efficiently, faster, and cheaper. Things are already changing with better data driven decision making, more accurate diagnostic tools and medical devices retrieving and processing real time data. The practice of Medicine has changed dramatically in the past twenty years. Doctors have gone from not having enough data on a patient, to far too much data to understand. They need tools to help them to process massive amounts of data humans are incapable of processing and to retrieve data from sources they could not previously. These data tools are enabling startups to add value in ways traditional care providers have not. We are seeing the importance of these tools now as Mount Sinai researchers use AI to evaluate patients with COVID-19(6).

Attractive VC Returns

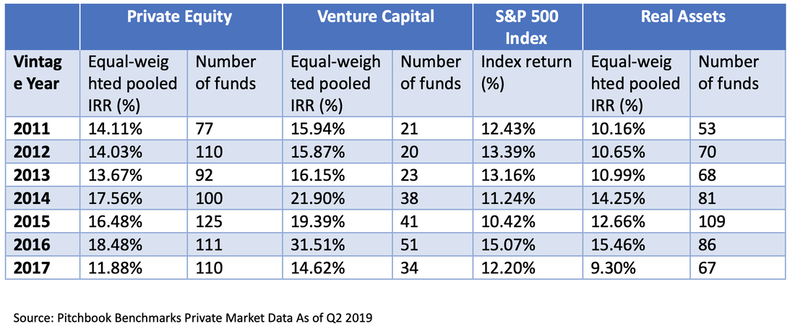

Many successful startup founders and executives of healthcare companies qualify as accredited investors and therefore, they can serve as LPs to VCs. So why not bring your experience and expertise to investments you make in a VC fund? Leveraging your talents to help grow your investments without having primary responsibility for managing them? VC funds have higher yields than other asset classes. As illustrated in the table below, VC funds on average have higher returns than private equity funds, the S&P 500 Index, and funds which invest in real assets. Furthermore, it's been publicized that hedge funds continuously trail the broader stock market(7) and mutual funds underperform(8). First time private capital funds also historically outperform non-first time funds and have smaller check size requirements, providing investment opportunities to individual investors. Establishing that VC Funds have a higher return than other asset classes should incentivize successful founders and executives to invest in VC funds focused on health tech startups leveraging AI. VC funds focused on health tech-AI can potentially significantly impact healthcare while achieving higher financial returns relative to investing in other asset classes. These health tech-AI focused funds should be considered because of their potential impact on healthcare while potentially achieving higher financial returns relative to investing in other asset classes.

Many successful startup founders and executives of healthcare companies qualify as accredited investors and therefore, they can serve as LPs to VCs. So why not bring your experience and expertise to investments you make in a VC fund? Leveraging your talents to help grow your investments without having primary responsibility for managing them? VC funds have higher yields than other asset classes. As illustrated in the table below, VC funds on average have higher returns than private equity funds, the S&P 500 Index, and funds which invest in real assets. Furthermore, it's been publicized that hedge funds continuously trail the broader stock market(7) and mutual funds underperform(8). First time private capital funds also historically outperform non-first time funds and have smaller check size requirements, providing investment opportunities to individual investors. Establishing that VC Funds have a higher return than other asset classes should incentivize successful founders and executives to invest in VC funds focused on health tech startups leveraging AI. VC funds focused on health tech-AI can potentially significantly impact healthcare while achieving higher financial returns relative to investing in other asset classes. These health tech-AI focused funds should be considered because of their potential impact on healthcare while potentially achieving higher financial returns relative to investing in other asset classes.

Advising VC Portfolio Companies

Investing in a VC fund is not without its risks. Yet, successful health tech startup founders, AI startup founders and healthcare company executives can potentially help portfolio companies grow and navigate challenges by acting as advisors to VC firms. What these potential advisors have to offer differs from one to the next. A successful founder can help a startup CEO navigate challenges and scale. A healthcare company’s executive which has extensive industry expertise can help portfolio companies understand the nuances of the market, establish new partnerships, and identify potential fits for products and services. A former CTO of an AI startup might help solve a portfolio company’s technical challenge. These advisors can be crucial to the success of a portfolio company. Therefore, former founders and executives can potentially increase their chances of receiving a positive financial return on their investments by acting as advisors at VC firms where they also are LPs.

Investing in a VC fund is not without its risks. Yet, successful health tech startup founders, AI startup founders and healthcare company executives can potentially help portfolio companies grow and navigate challenges by acting as advisors to VC firms. What these potential advisors have to offer differs from one to the next. A successful founder can help a startup CEO navigate challenges and scale. A healthcare company’s executive which has extensive industry expertise can help portfolio companies understand the nuances of the market, establish new partnerships, and identify potential fits for products and services. A former CTO of an AI startup might help solve a portfolio company’s technical challenge. These advisors can be crucial to the success of a portfolio company. Therefore, former founders and executives can potentially increase their chances of receiving a positive financial return on their investments by acting as advisors at VC firms where they also are LPs.

For those health tech startup founders, AI startup founders, and executives of healthcare companies looking to invest in a VC fund with the goal of transforming healthcare through AI, I recommend considering DigitalDx Ventures. DigitalDx Ventures is an early stage impact focused VC where I currently serve as a Fellow and in my role, I have become very familiar with their investment opportunity and can speak about it with authority.

Located in the heart of Silicon Valley on Sand-Hill road, DigitalDx invests in health tech-AI startups that save lives through diagnostics. DigitalDx is extremely passionate about crossing the power of big data and artificial intelligence with medicine to forever change the way we manage and deliver healthcare for everyone. The team is very diverse spanning doctors, lawyers, CEO's, venture capitalists and investors knowledgeable about all aspects of finding, nurturing, scaling, and exiting our companies. Top-tier venture funds in the valley have relied on DigitalDx’s partners for years to find follow on deals the team is deeply connected to Stanford and UCSF, among other preeminent medical institutions. In addition, DigitalDx considers impact a core part of its identity and investment approach. Collectively, Fund Partners have invested in over a dozen companies which today have a combined value of >$4 Billion, with five exits at 5x to 40x multiples and collectively have over 60 issued patents to the credit of their team.

DigitalDx Ventures has invested in six game changing companies that you are sure to be hearing about in the coming year!

For information on DigitalDx Ventures, please contact [email protected]

Located in the heart of Silicon Valley on Sand-Hill road, DigitalDx invests in health tech-AI startups that save lives through diagnostics. DigitalDx is extremely passionate about crossing the power of big data and artificial intelligence with medicine to forever change the way we manage and deliver healthcare for everyone. The team is very diverse spanning doctors, lawyers, CEO's, venture capitalists and investors knowledgeable about all aspects of finding, nurturing, scaling, and exiting our companies. Top-tier venture funds in the valley have relied on DigitalDx’s partners for years to find follow on deals the team is deeply connected to Stanford and UCSF, among other preeminent medical institutions. In addition, DigitalDx considers impact a core part of its identity and investment approach. Collectively, Fund Partners have invested in over a dozen companies which today have a combined value of >$4 Billion, with five exits at 5x to 40x multiples and collectively have over 60 issued patents to the credit of their team.

DigitalDx Ventures has invested in six game changing companies that you are sure to be hearing about in the coming year!

For information on DigitalDx Ventures, please contact [email protected]

(1) https://www.cs.ucla.edu/center-for-smart-health/

(2) https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

(3) Hampleton Partners: Healthtech M&A Market Report 1H 2020

(4) https://www.accenture.com/us-en/insight-artificial-intelligence-healthcare%C2%A0

(5) CB Insights: State Of Healthcare Q1'20 Report: Investment & Sector Trends To Watch

(6) https://healthitanalytics.com/news/artificial-intelligence-tool-identifies-covid-19-in-ct-scans

(7) https://www.marketwatch.com/story/hedge-funds-still-cant-keep-up-with-the-stock-market-2019-10-15

(8) https://www.sciencedirect.com/science/article/abs/pii/S0304405X10002448

(2) https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

(3) Hampleton Partners: Healthtech M&A Market Report 1H 2020

(4) https://www.accenture.com/us-en/insight-artificial-intelligence-healthcare%C2%A0

(5) CB Insights: State Of Healthcare Q1'20 Report: Investment & Sector Trends To Watch

(6) https://healthitanalytics.com/news/artificial-intelligence-tool-identifies-covid-19-in-ct-scans

(7) https://www.marketwatch.com/story/hedge-funds-still-cant-keep-up-with-the-stock-market-2019-10-15

(8) https://www.sciencedirect.com/science/article/abs/pii/S0304405X10002448