Calling All VCs: Women in Life Sciences need You

Irene Manousiouthakis (MBA, The Wharton School) *[email protected]u

Irene Manousiouthakis (MBA, The Wharton School) *[email protected]u

In January of 2016, the National Institutes of Health (NIH) instituted a policy expecting future grant applications to account for sex as a biological variable in vertebrate animals and human studies.(1) Biomedical research ranging from neuroscience to pharmacology has historically focused on male animals and cells, possibly due to convention, complexity or costs.(2) (3) The underrepresentation of females in these studies has had severe consequences.

The Food and Drug Administration (FDA) has pulled drugs from the market due to unexpected adverse events in women, a direct result of preclinical research failing to account for key differences between sexes in the drug discovery pipeline.(4) For example, in 2000, the drug Propulsid had to be taken off the market due to a potentially fatal ventricular arrhythmia (Torsades de Pointes).(4) This side effect of the drug has a higher risk in women given that “the interval between heart muscle contractions is naturally longer for women than for men.”(5) In addition, in the field of neuroscience, certain mood and anxiety disorders such as major depressive disorder or post-traumatic stress disorder are twice as prevalent in women.(6) Despite this, “common behavioral tests designed to model their symptoms in rodents were developed and validated in males. The result has been an unclear picture of the neural mechanisms that may underlie disease susceptibility in women,” writes Rebecca M. Shansky, a neuroscientist at Northeastern University.(6)

Why did it take the NIH so long to put this policy in place? The NIH mandated enrollment of women in human clinical trials back in 1993.(3) It took 23 years for the NIH to realize that studies encompassing both sexes should be a fundamental requirement for grant-worthy preclinical research. A likely answer to this question is the fact that, historically, women have been underrepresented in life sciences, a field which has widespread health implications.(7) According to Shansky, it is important that going forward, “researchers do not allow antiquated gender stereotypes to bias standards for scientific rigor.”(6) In fact, research suggests that it is in our best interest as a society to promote gender equality in life sciences in order to improve our standard of care and long-term health outcomes, not just for women, but for everyone.(8)

Investing in women in the fields of science, technology, engineering, and mathematics (STEM) is not a new concept among the venture capital (VC) community. Prominent women show support for STEM, such as Karlie Kloss through Kode With Klossy or Melinda Gates through Pivotal Ventures. These are fantastic initiatives, especially considering that women broadly make up about a third of STEM degrees earned from postsecondary institutions.(9) In fact, more than half of degrees obtained in the life sciences happen to be earned by women.(9) The more we promote life sciences as a field that women are able to pursue and actually be successful in, the more we can further drive change across the entire spectrum of STEM while continuously seeking to improve the health of our communities.

Unfortunately, there are few women-led power players in this space. One that is relatively well-known is Elizabeth Holmes’ infamous Theranos, but Holmes isn’t exactly the role model we want to fall back on.

The real impetus for change lies in large scale venture investment in women founders who are innovating in the fields of biological and biomedical sciences, impacting industries such as pharmaceuticals, biotechnology, diagnostics, or medical devices. By backing these founders, firms have an opportunity to invest in improving healthcare outcomes.

The Bias Against Investment in Women Across the VC Industry

First, we must confront the unfortunate reality that there is a lack of investment in women founders across the venture capital industry as a whole.

Globally, only 1 in 5 venture capital investments were in companies with at least one female founder as of August 2019.(10) In terms of venture dollars, for every dollar invested in a company with at least one female founder, seven dollars were invested in companies with an all-male founding team.(10)

Moreover, according to Crunchbase data as of May 2020, of the almost 600 global companies listed as unicorns, or privately held startup companies valued at over $1 billion, less than 10% had at least one female founder.

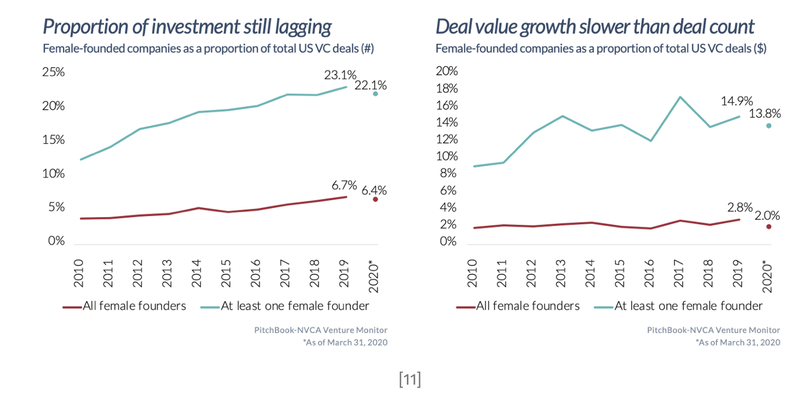

This trend holds true when one focuses on the United States, where less than a fourth of VC deals are placed in companies that have at least one female founder, accounting for less than a sixth of the dollars spent by these VC firms.(11) Less than 13% of US-based unicorns have at least one female founder, according to Crunchbase data as of May 2020. An all female founding team fares even worse than this.(11)

Of course, there are a variety of factors that play a role in this, most notably the lack of women-decision makers in VC. It is also worth noting that the proportion of VC dollars invested in female-only founding teams has stagnated around 2% for the last decade with little indication of an upward trend, a worrisome signal going forward.

The Food and Drug Administration (FDA) has pulled drugs from the market due to unexpected adverse events in women, a direct result of preclinical research failing to account for key differences between sexes in the drug discovery pipeline.(4) For example, in 2000, the drug Propulsid had to be taken off the market due to a potentially fatal ventricular arrhythmia (Torsades de Pointes).(4) This side effect of the drug has a higher risk in women given that “the interval between heart muscle contractions is naturally longer for women than for men.”(5) In addition, in the field of neuroscience, certain mood and anxiety disorders such as major depressive disorder or post-traumatic stress disorder are twice as prevalent in women.(6) Despite this, “common behavioral tests designed to model their symptoms in rodents were developed and validated in males. The result has been an unclear picture of the neural mechanisms that may underlie disease susceptibility in women,” writes Rebecca M. Shansky, a neuroscientist at Northeastern University.(6)

Why did it take the NIH so long to put this policy in place? The NIH mandated enrollment of women in human clinical trials back in 1993.(3) It took 23 years for the NIH to realize that studies encompassing both sexes should be a fundamental requirement for grant-worthy preclinical research. A likely answer to this question is the fact that, historically, women have been underrepresented in life sciences, a field which has widespread health implications.(7) According to Shansky, it is important that going forward, “researchers do not allow antiquated gender stereotypes to bias standards for scientific rigor.”(6) In fact, research suggests that it is in our best interest as a society to promote gender equality in life sciences in order to improve our standard of care and long-term health outcomes, not just for women, but for everyone.(8)

Investing in women in the fields of science, technology, engineering, and mathematics (STEM) is not a new concept among the venture capital (VC) community. Prominent women show support for STEM, such as Karlie Kloss through Kode With Klossy or Melinda Gates through Pivotal Ventures. These are fantastic initiatives, especially considering that women broadly make up about a third of STEM degrees earned from postsecondary institutions.(9) In fact, more than half of degrees obtained in the life sciences happen to be earned by women.(9) The more we promote life sciences as a field that women are able to pursue and actually be successful in, the more we can further drive change across the entire spectrum of STEM while continuously seeking to improve the health of our communities.

Unfortunately, there are few women-led power players in this space. One that is relatively well-known is Elizabeth Holmes’ infamous Theranos, but Holmes isn’t exactly the role model we want to fall back on.

The real impetus for change lies in large scale venture investment in women founders who are innovating in the fields of biological and biomedical sciences, impacting industries such as pharmaceuticals, biotechnology, diagnostics, or medical devices. By backing these founders, firms have an opportunity to invest in improving healthcare outcomes.

The Bias Against Investment in Women Across the VC Industry

First, we must confront the unfortunate reality that there is a lack of investment in women founders across the venture capital industry as a whole.

Globally, only 1 in 5 venture capital investments were in companies with at least one female founder as of August 2019.(10) In terms of venture dollars, for every dollar invested in a company with at least one female founder, seven dollars were invested in companies with an all-male founding team.(10)

Moreover, according to Crunchbase data as of May 2020, of the almost 600 global companies listed as unicorns, or privately held startup companies valued at over $1 billion, less than 10% had at least one female founder.

This trend holds true when one focuses on the United States, where less than a fourth of VC deals are placed in companies that have at least one female founder, accounting for less than a sixth of the dollars spent by these VC firms.(11) Less than 13% of US-based unicorns have at least one female founder, according to Crunchbase data as of May 2020. An all female founding team fares even worse than this.(11)

Of course, there are a variety of factors that play a role in this, most notably the lack of women-decision makers in VC. It is also worth noting that the proportion of VC dollars invested in female-only founding teams has stagnated around 2% for the last decade with little indication of an upward trend, a worrisome signal going forward.

The Bias Against Investment in Women in the Life Sciences vs B2C

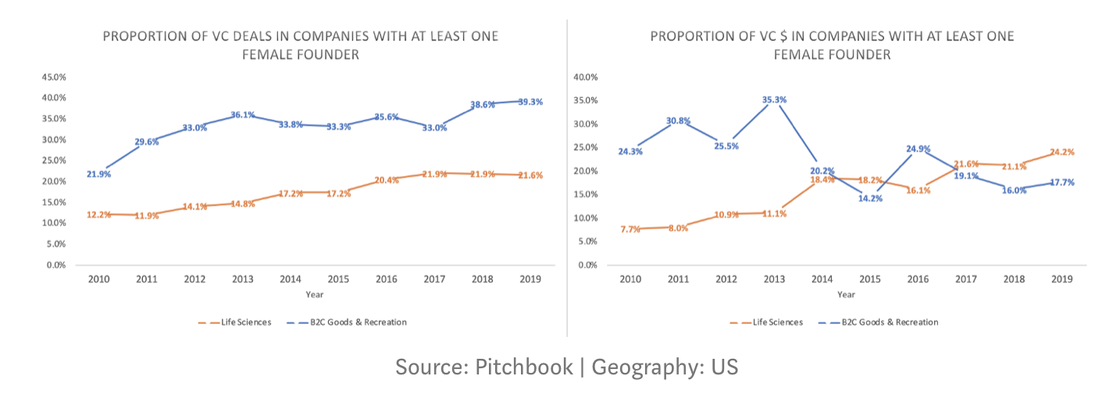

Despite low amounts of funding going to women overall, the bias against investment in women is actually amplified in the life sciences sector, compared to other hyped sectors such as business to consumer goods & recreation (B2C) where women are known to shine.

In fact, 2019 was a box office year for the B2C space with multiple women-led companies breaking into unicorn status, including Glossier — founded by Emily Weiss, Rent the Runway — founded by Jennifer Hyman and Jennifer Fleiss, and Away — founded by Steph Korey and Jen Rubio. Crunchbase data as of May 2020 listed 11 US-based companies in this sector on the female-founded unicorn list.(12) Some other notable women-led companies outside of the unicorn list include The RealReal, which went public in 2019, and Moda Operandi ($650 million post-money valuation as of February 2019).(13) On the flip side, however, as of May 2020, there are only two companies that have hit unicorn status in the life sciences sector: 23andMe and Ginkgo Bioworks.(14) Genetic analytics company 23andMe became a unicorn back in 2015 and synthetic biology company Ginkgo Bioworks became one in 2017. Since 2017, no others have been added to the list. One notable company just shy of the list is Humacyte ($789 million post-money valuation as of February 2019).(13)

You don’t see this bias at just the unicorn status level, but the gap shows up in VC deal flow as well. As of 2019, women entrepreneurs in the B2C space were almost twice as likely to receive funding versus their counterparts in the life sciences sector. Despite this large gap, there has been an upward trend in the proportion invested in life sciences companies with at least one female founder, which might partly be explained given the capital intensive nature of the sector versus that of B2C. It remains clear, however, that B2C seems to be pulling up the average of investment in women across the venture capital industry as a whole. This gives the impression that women leaders are more suited for B2C sectors such as beauty or fashion rather than STEM-focused sectors.

Despite low amounts of funding going to women overall, the bias against investment in women is actually amplified in the life sciences sector, compared to other hyped sectors such as business to consumer goods & recreation (B2C) where women are known to shine.

In fact, 2019 was a box office year for the B2C space with multiple women-led companies breaking into unicorn status, including Glossier — founded by Emily Weiss, Rent the Runway — founded by Jennifer Hyman and Jennifer Fleiss, and Away — founded by Steph Korey and Jen Rubio. Crunchbase data as of May 2020 listed 11 US-based companies in this sector on the female-founded unicorn list.(12) Some other notable women-led companies outside of the unicorn list include The RealReal, which went public in 2019, and Moda Operandi ($650 million post-money valuation as of February 2019).(13) On the flip side, however, as of May 2020, there are only two companies that have hit unicorn status in the life sciences sector: 23andMe and Ginkgo Bioworks.(14) Genetic analytics company 23andMe became a unicorn back in 2015 and synthetic biology company Ginkgo Bioworks became one in 2017. Since 2017, no others have been added to the list. One notable company just shy of the list is Humacyte ($789 million post-money valuation as of February 2019).(13)

You don’t see this bias at just the unicorn status level, but the gap shows up in VC deal flow as well. As of 2019, women entrepreneurs in the B2C space were almost twice as likely to receive funding versus their counterparts in the life sciences sector. Despite this large gap, there has been an upward trend in the proportion invested in life sciences companies with at least one female founder, which might partly be explained given the capital intensive nature of the sector versus that of B2C. It remains clear, however, that B2C seems to be pulling up the average of investment in women across the venture capital industry as a whole. This gives the impression that women leaders are more suited for B2C sectors such as beauty or fashion rather than STEM-focused sectors.

Consumer sentiment also displays this bias. There’s no denying that media coverage has been vastly different between the B2C and life sciences sectors. Looking at Crunchbase Rankings, a metric used to measure the prominence of an entity based on a variety of factors including news articles, the top 10 listed US-based companies founded by women in the B2C sector had an average rank of 262.(15) Looking at a similar top 10 in the life sciences sector, the average rank was devastatingly lower at 1188.(16)

But investors should be weary of falling for the sexiness of B2C when supporting women. This approach could do more to emphasize gender stereotypes than break them. In addition, the B2C space naturally has fewer barriers to entry, primarily brand-building activities, compared to the life sciences space, which not only has to deal with brand, but also intellectual property and technology hurdles. This creates an environment of increased B2C competition. COVID-19 has also illustrated the less than recession-proof nature of the sector with its disastrous impact on consumer spending: advance estimates of US retail and food services sales for April 2020 were more than 20% below April 2019.(17) The fact of the matter is that life sciences has the potential to impact everyone, and we as a society have chosen instead to focus more on a sector that caters to only some.

Pushing for Change

As a community of diverse investors, there are ways that we can look to mitigate these biases, and major initiatives like AllRaise have already brought a lot of awareness to the cause. However, successful entrepreneurs and investors still have a major role to play in changing the narrative. The following list outlines several steps that can be taken to drive change:

1. Invest in funds that back women entrepreneurs in the life sciences.

It may be daunting to invest directly in life sciences, a sector that requires a significant amount of expertise to take a calculated risk. The life sciences sector naturally requires larger amounts of upfront capital, unless investments are placed in the earlier stages where more risk is involved. This is exacerbated further for women entrepreneurs who face even more hurdles. However, with 56% of limited partners (LPs) having women in decision-making roles across the VC industry as of August 2019, LPs have an opportunity to change the status quo.(10) Placing indirect investments as a limited partner in funds that directly invest in women entrepreneurs in the life sciences can help mitigate the aforementioned risks, while still pushing for change.

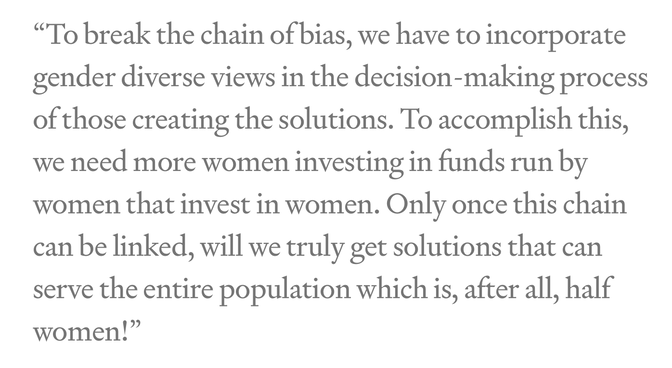

Portfolia and DigitalDx Ventures are just a few of the funds that incorporate this philosophy into their investment strategy. Portfolia developed the Portfolia FemTech Fund as a means to help women “invest in high-potential opportunities that can be both profitable and grant women greater health and wellness.”(18) DigitalDx Ventures is a venture fund that invests in diagnostics augmented by artificial intelligence and data. More than half of their portfolio companies are those with at least one woman on their founding team, and half of those have women in the C-Suite. Michele Colucci, Co-Founder and Managing Partner, explains the importance of this strategy:

But investors should be weary of falling for the sexiness of B2C when supporting women. This approach could do more to emphasize gender stereotypes than break them. In addition, the B2C space naturally has fewer barriers to entry, primarily brand-building activities, compared to the life sciences space, which not only has to deal with brand, but also intellectual property and technology hurdles. This creates an environment of increased B2C competition. COVID-19 has also illustrated the less than recession-proof nature of the sector with its disastrous impact on consumer spending: advance estimates of US retail and food services sales for April 2020 were more than 20% below April 2019.(17) The fact of the matter is that life sciences has the potential to impact everyone, and we as a society have chosen instead to focus more on a sector that caters to only some.

Pushing for Change

As a community of diverse investors, there are ways that we can look to mitigate these biases, and major initiatives like AllRaise have already brought a lot of awareness to the cause. However, successful entrepreneurs and investors still have a major role to play in changing the narrative. The following list outlines several steps that can be taken to drive change:

1. Invest in funds that back women entrepreneurs in the life sciences.

It may be daunting to invest directly in life sciences, a sector that requires a significant amount of expertise to take a calculated risk. The life sciences sector naturally requires larger amounts of upfront capital, unless investments are placed in the earlier stages where more risk is involved. This is exacerbated further for women entrepreneurs who face even more hurdles. However, with 56% of limited partners (LPs) having women in decision-making roles across the VC industry as of August 2019, LPs have an opportunity to change the status quo.(10) Placing indirect investments as a limited partner in funds that directly invest in women entrepreneurs in the life sciences can help mitigate the aforementioned risks, while still pushing for change.

Portfolia and DigitalDx Ventures are just a few of the funds that incorporate this philosophy into their investment strategy. Portfolia developed the Portfolia FemTech Fund as a means to help women “invest in high-potential opportunities that can be both profitable and grant women greater health and wellness.”(18) DigitalDx Ventures is a venture fund that invests in diagnostics augmented by artificial intelligence and data. More than half of their portfolio companies are those with at least one woman on their founding team, and half of those have women in the C-Suite. Michele Colucci, Co-Founder and Managing Partner, explains the importance of this strategy:

2. Invest in life sciences-focused funds with women partners.

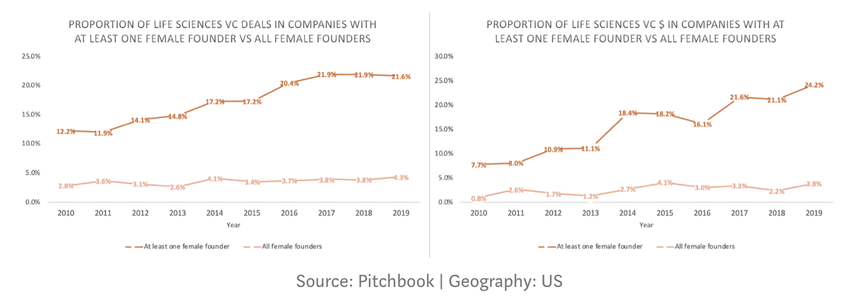

The underlying issue with the venture community is the disproportionate power afforded to a male in a founding team, even if there are women involved. As shown earlier, as of 2019, the number of VC deals in companies with at least one female founder was 3.4x higher than the number in companies with all female founders. In the life sciences sector, this discrepancy is even worse, with that same multiple increasing to 5x. If we are looking at the proportion of VC dollars, the multiple in life sciences is 6.4x.

The underlying issue with the venture community is the disproportionate power afforded to a male in a founding team, even if there are women involved. As shown earlier, as of 2019, the number of VC deals in companies with at least one female founder was 3.4x higher than the number in companies with all female founders. In the life sciences sector, this discrepancy is even worse, with that same multiple increasing to 5x. If we are looking at the proportion of VC dollars, the multiple in life sciences is 6.4x.

In light of this, what we need to do is support more all-women founded companies in the sector. We could achieve that by pouring capital into gender-balanced funds, where plenty of research has been done to showcase the benefits of investing in gender-balanced teams. For example, there is a reduction in the median number of years required for an exit.(10) In addition, funds with women managers are twice as likely to invest in female-founded companies and three times as likely to invest in those with female CEOs.(19) Investing in such gender-balanced funds is necessary if we are to change the current dynamic of the life sciences sector.

Unfortunately as of August 2019, only 12% of venture firms and angel groups in the US actually had any female decision-makers.(10) Women in these positions are more likely to be approached by female founders seeking investment, resulting in increased deal flow and exposure to differentiated investment opportunities.(10) With the rise of burgeoning industries such as femtech, this cannot go unnoticed. Heather Bowerman, CEO and Founder of DotLab, an endometriosis diagnostic company, explains why this is the case:

Unfortunately as of August 2019, only 12% of venture firms and angel groups in the US actually had any female decision-makers.(10) Women in these positions are more likely to be approached by female founders seeking investment, resulting in increased deal flow and exposure to differentiated investment opportunities.(10) With the rise of burgeoning industries such as femtech, this cannot go unnoticed. Heather Bowerman, CEO and Founder of DotLab, an endometriosis diagnostic company, explains why this is the case:

3. Invest directly in women founders working in the emerging field of diagnostics.

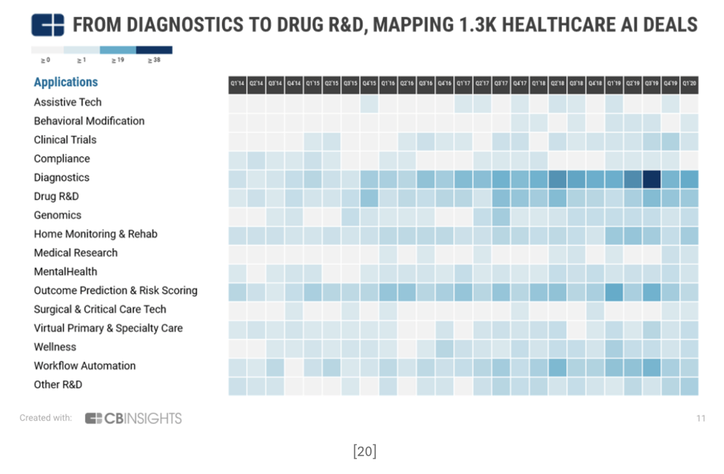

Another way to mitigate the risk involved in investing in the life sciences industry as a whole might be to focus on those sub-sectors of the industry where the benefits are relatively easy to understand and have the potential for a shorter time to market, subsequently leading to faster returns. The emerging field of diagnostics, and in particular, those companies utilizing artificial intelligence (AI) and machine learning (ML) to develop tests, has seen an influx of deal flow compared to other healthcare AI sub-sectors:

Another way to mitigate the risk involved in investing in the life sciences industry as a whole might be to focus on those sub-sectors of the industry where the benefits are relatively easy to understand and have the potential for a shorter time to market, subsequently leading to faster returns. The emerging field of diagnostics, and in particular, those companies utilizing artificial intelligence (AI) and machine learning (ML) to develop tests, has seen an influx of deal flow compared to other healthcare AI sub-sectors:

This increased deal flow showcases a powerful trend within the space to develop non-invasive, cheaper, and more accurate tests. The sector stands out as a prime candidate for a first time investment in the life sciences space for the following reasons:

----------------------------------------

a. Shorter time to market and lower upfront cost lead to faster returns with less perceived risk.

With companies now using AI/ML to rapidly iterate on potential solutions to widespread healthcare problems, diagnostics that focus on utilizing these technologies present the potential for less overall risk. This is all made possible through the increasing availability of clinical data and research on the human genome over the last decade or so which these companies are able to leverage.(10) In particular, diagnostics that do not require invasive procedures will come to market quicker versus other sub-sectors in the life sciences space that might require more invasive testing and FDA trials in order to commercialize. For example, with the availability of the Clinical Laboratory Improvement Amendments (CLIA) options as well as the FDA’s emphasis on companion diagnostics, the path to approval can move more quickly while using less money to get to proof of concept.(21)(22) In addition, without the requirement for significant large-scale testing, upfront investment costs are likely to be lower, presenting the opportunity to diversify a portfolio without having to place a sizable investment as might be required in a sub-sector such as pharmaceuticals.

b. Impact on health outcomes are widespread.

When diagnostics are less expensive and thus more accessible, they have the potential to positively impact the health outcomes of numerous types of people from both a preventive and targeted treatment perspective. Not only do more people have the opportunity to get tested, but the time it takes for a patient to get vital information regarding their health rapidly decreases. In addition, mental hurdles surrounding pursuing an invasive or costly procedure are diminished. For certain cancers, such as breast or thyroid cancer, early detection is also critical and can lead to a five-year survival rate of 99%.(23) This potential within diagnostics was one of the main catalysts behind the rapid success of Theranos, once valued at $10 billion, before the company was deemed fraudulent.

c. COVID-19 has revealed a critical need for rapid diagnostic capabilities.

Many diagnostic companies have rapidly ramped up testing or pivoted for the time being in order to meet the severe need due to the public health emergency. Not only has COVID-19 uncovered the critical importance of diagnostics to help our communities, but accurate, non-invasive diagnostics are a vital part of “flattening the curve.” When more people are tested and equipped with accurate knowledge of their own diagnosis, they can better protect those around them and prevent the spread of disease. Moreover, with the increase in international travel, and the nature of viruses which mutate quickly, the chances of another pandemic are very real. There is increasing evidence to suggest that climate change will also affect infectious disease occurrence.(24) A prime example of this occurs with malaria, where “analyses have shown that the malaria epidemic risk increases around five-fold in the year after an El Niño event.”(24) The companies that are better equipped to utilize AI/ML to quickly come up with viable diagnostics will be able to better serve our communities during these times and potentially outperform during a recession.

d. Personalized medicine requires rapid diagnostics.

With tangential fields such as personalized or precision medicine gaining traction, the importance of accurate and rapid diagnostic methods is magnified. The May 2020 issue of Trends in Biotechnology showcased the trend with its article on Enabling Technologies for Personalized and Precision Medicine where the authors claim that “individualizing patient treatment is a core objective of the medical field.”(25) If that claim is true, rapid and accurate diagnostics are a necessity to facilitate our ability to individualize care as intervention and diagnosis will need to be “adjusted in a serial fashion for ongoing treatment optimization.”(25)

----------------------------------------

As more and more data is collected to help accurately identify indicators of disease or disease itself, the benefits will ripple throughout the healthcare system. One notable startup in the diagnostics space with women on the founding team is Nephrosant, a developer of a urine-based diagnostic test intended to detect kidney disease before symptoms occur. It provides 98% overall accuracy over competition that utilizes traditional blood tests. Another diagnostic company is Optina Diagnostics, a developer of a simple eye scan designed to detect key biomarkers of Alzheimer’s disease. Optina Diagnostics’ Alzheimer’s diagnostic is the only one to receive the FDA’s breakthrough therapy designation, which is “intended to expedite the development and review of drugs for serious or life-threatening conditions,” given its ability to detect digital biomarkers 8–10 years before brain damage.(26)

----------------------------------------

a. Shorter time to market and lower upfront cost lead to faster returns with less perceived risk.

With companies now using AI/ML to rapidly iterate on potential solutions to widespread healthcare problems, diagnostics that focus on utilizing these technologies present the potential for less overall risk. This is all made possible through the increasing availability of clinical data and research on the human genome over the last decade or so which these companies are able to leverage.(10) In particular, diagnostics that do not require invasive procedures will come to market quicker versus other sub-sectors in the life sciences space that might require more invasive testing and FDA trials in order to commercialize. For example, with the availability of the Clinical Laboratory Improvement Amendments (CLIA) options as well as the FDA’s emphasis on companion diagnostics, the path to approval can move more quickly while using less money to get to proof of concept.(21)(22) In addition, without the requirement for significant large-scale testing, upfront investment costs are likely to be lower, presenting the opportunity to diversify a portfolio without having to place a sizable investment as might be required in a sub-sector such as pharmaceuticals.

b. Impact on health outcomes are widespread.

When diagnostics are less expensive and thus more accessible, they have the potential to positively impact the health outcomes of numerous types of people from both a preventive and targeted treatment perspective. Not only do more people have the opportunity to get tested, but the time it takes for a patient to get vital information regarding their health rapidly decreases. In addition, mental hurdles surrounding pursuing an invasive or costly procedure are diminished. For certain cancers, such as breast or thyroid cancer, early detection is also critical and can lead to a five-year survival rate of 99%.(23) This potential within diagnostics was one of the main catalysts behind the rapid success of Theranos, once valued at $10 billion, before the company was deemed fraudulent.

c. COVID-19 has revealed a critical need for rapid diagnostic capabilities.

Many diagnostic companies have rapidly ramped up testing or pivoted for the time being in order to meet the severe need due to the public health emergency. Not only has COVID-19 uncovered the critical importance of diagnostics to help our communities, but accurate, non-invasive diagnostics are a vital part of “flattening the curve.” When more people are tested and equipped with accurate knowledge of their own diagnosis, they can better protect those around them and prevent the spread of disease. Moreover, with the increase in international travel, and the nature of viruses which mutate quickly, the chances of another pandemic are very real. There is increasing evidence to suggest that climate change will also affect infectious disease occurrence.(24) A prime example of this occurs with malaria, where “analyses have shown that the malaria epidemic risk increases around five-fold in the year after an El Niño event.”(24) The companies that are better equipped to utilize AI/ML to quickly come up with viable diagnostics will be able to better serve our communities during these times and potentially outperform during a recession.

d. Personalized medicine requires rapid diagnostics.

With tangential fields such as personalized or precision medicine gaining traction, the importance of accurate and rapid diagnostic methods is magnified. The May 2020 issue of Trends in Biotechnology showcased the trend with its article on Enabling Technologies for Personalized and Precision Medicine where the authors claim that “individualizing patient treatment is a core objective of the medical field.”(25) If that claim is true, rapid and accurate diagnostics are a necessity to facilitate our ability to individualize care as intervention and diagnosis will need to be “adjusted in a serial fashion for ongoing treatment optimization.”(25)

----------------------------------------

As more and more data is collected to help accurately identify indicators of disease or disease itself, the benefits will ripple throughout the healthcare system. One notable startup in the diagnostics space with women on the founding team is Nephrosant, a developer of a urine-based diagnostic test intended to detect kidney disease before symptoms occur. It provides 98% overall accuracy over competition that utilizes traditional blood tests. Another diagnostic company is Optina Diagnostics, a developer of a simple eye scan designed to detect key biomarkers of Alzheimer’s disease. Optina Diagnostics’ Alzheimer’s diagnostic is the only one to receive the FDA’s breakthrough therapy designation, which is “intended to expedite the development and review of drugs for serious or life-threatening conditions,” given its ability to detect digital biomarkers 8–10 years before brain damage.(26)

My Two Cents

The pathway to increased investment in women entrepreneurs in the life sciences is no small feat. There are numerous biases within the venture capital industry as a whole coupled with additional hurdles that women entrepreneurs in the life sciences are facing, especially when compared to their B2C counterparts. It is imperative for the health of our society and the promotion of successful women in STEM that the venture capital community take the necessary action to invest in these women. Some actionable steps as an investor include investing in funds that back women entrepreneurs in the life sciences, investing in life sciences-focused funds with women partners, or investing directly in women founders working in the emerging field of diagnostics. Taking action through any one of these methods will increase the chances of success and recognition that many of these women deserve while diversifying into investments with the potential to achieve outsized returns.(27)(28)

----------------------------------------

The pathway to increased investment in women entrepreneurs in the life sciences is no small feat. There are numerous biases within the venture capital industry as a whole coupled with additional hurdles that women entrepreneurs in the life sciences are facing, especially when compared to their B2C counterparts. It is imperative for the health of our society and the promotion of successful women in STEM that the venture capital community take the necessary action to invest in these women. Some actionable steps as an investor include investing in funds that back women entrepreneurs in the life sciences, investing in life sciences-focused funds with women partners, or investing directly in women founders working in the emerging field of diagnostics. Taking action through any one of these methods will increase the chances of success and recognition that many of these women deserve while diversifying into investments with the potential to achieve outsized returns.(27)(28)

----------------------------------------

About the author: Irene Manousiouthakis is a former Venture Fellow at DigitalDX Ventures, a women-led fund investing in the future of medicine and digital health. She studied Bioengineering at the University of Pennsylvania and is currently an MBA candidate in Marketing and Finance at The Wharton School.

This paper was written with support from DigitalDX Ventures, however all views are my own. Special thanks to Michele Colucci (Managing Partner, DigitalDX Ventures) and my fellow peers who helped inspire and facilitate my research. Although this paper addresses biases specifically against women, I would also like to directly highlight the research of two of my peers, Joseph Kemp and Eddie Chan, who have focused on Why Diverse Investors Need to Invest in Healthcare AI Now and How Venture Investment in Digital Health can Reduce Bias and Break Poverty Cycles.

Please note: Although I have tried to use gender-inclusive language where possible, available data from several of my sources mainly utilizes “female” as an overarching term to describe women, which I have replicated when citing others. Please feel free to reach out to me with suggestions or improvements.

----------------------------------------

This paper was written with support from DigitalDX Ventures, however all views are my own. Special thanks to Michele Colucci (Managing Partner, DigitalDX Ventures) and my fellow peers who helped inspire and facilitate my research. Although this paper addresses biases specifically against women, I would also like to directly highlight the research of two of my peers, Joseph Kemp and Eddie Chan, who have focused on Why Diverse Investors Need to Invest in Healthcare AI Now and How Venture Investment in Digital Health can Reduce Bias and Break Poverty Cycles.

Please note: Although I have tried to use gender-inclusive language where possible, available data from several of my sources mainly utilizes “female” as an overarching term to describe women, which I have replicated when citing others. Please feel free to reach out to me with suggestions or improvements.

----------------------------------------

(1) Sex as a Biological Variable: A Step Toward Stronger Science, Better Health

(2) Policy: NIH to balance sex in cell and animal studies

(3) Sex Bias in Neuroscience and Biomedical Research

(4) Recommendations concerning the new US National Institutes of Health initiative to balance the sex of cells and animals in preclinical research

(5) GAO-01–286R Drug Safety: Most Drugs Withdrawn in Recent Years Had Greater Health Risks for Women

(6) Are hormones a “female problem” for animal research?

(7) STEM Education Data and Trends

(8) Gender equality in science, medicine, and global health: where are we at and why does it matter?

(9) Women in Science, Technology, Engineering, and Mathematics (STEM): Quick Take

(10) All In: Women in the VC Ecosystem

(11) Q1 2020 PITCHBOOK-NVCA VENTURE MONITOR

(12) Includes the following industry groups: Commerce and Shopping, Consumer Goods, Consumer Electronics, Food and Beverage, and excludes Biotechnology, Financial Services, Privacy and Security, and Automotive

(13) PitchBook Unveils Interactive Dashboard on US Venture Capital Financing in Female-Founded Companies

(14) Includes the following industry groups: Biotechnology and excludes Verily Life Sciences, also known as Verily, which is an independent subsidiary of Alphabet Inc.

(15) Includes the following industry groups: Commerce and Shopping, Consumer Goods, Consumer Electronics, Food and Beverage, and excludes Biotechnology, Financial Services, Privacy and Security, and Automotive. Note: The ranking is a snapshot in time.

(16) Includes the following industry groups: Biotechnology

(17) ADVANCE MONTHLY SALES FOR RETAIL AND FOOD SERVICES, APRIL 2020

(18) FemTech Fund — Portfolia Investing Funds for Women

(19) Diana Report Women Entrepreneurs 2014: Bridging the Gender Gap in Venture Capital

(20) CB Insights Stories: Healthcare AI In Numbers Q1'20 (subscription required to “view story”)

(21) CLIA Waiver by Application

(22) Principles for Codevelopment of an In Vitro Companion Diagnostic

(23) Smarter, More Accurate, and Less Expensive: How Artificial Intelligence is Revolutionizing Cancer Diagnosis

(24) WHO | Climate change and human health — risks and responses. Summary.

(25) Enabling Technologies for Personalized and Precision Medicine

(26) Frequently Asked Questions: Breakthrough Therapies

(27) First Round 10 Year Project

(28) The Rising Tide: A “Learning-By-Investing” Initiative to Bridge the Gender Gap

(2) Policy: NIH to balance sex in cell and animal studies

(3) Sex Bias in Neuroscience and Biomedical Research

(4) Recommendations concerning the new US National Institutes of Health initiative to balance the sex of cells and animals in preclinical research

(5) GAO-01–286R Drug Safety: Most Drugs Withdrawn in Recent Years Had Greater Health Risks for Women

(6) Are hormones a “female problem” for animal research?

(7) STEM Education Data and Trends

(8) Gender equality in science, medicine, and global health: where are we at and why does it matter?

(9) Women in Science, Technology, Engineering, and Mathematics (STEM): Quick Take

(10) All In: Women in the VC Ecosystem

(11) Q1 2020 PITCHBOOK-NVCA VENTURE MONITOR

(12) Includes the following industry groups: Commerce and Shopping, Consumer Goods, Consumer Electronics, Food and Beverage, and excludes Biotechnology, Financial Services, Privacy and Security, and Automotive

(13) PitchBook Unveils Interactive Dashboard on US Venture Capital Financing in Female-Founded Companies

(14) Includes the following industry groups: Biotechnology and excludes Verily Life Sciences, also known as Verily, which is an independent subsidiary of Alphabet Inc.

(15) Includes the following industry groups: Commerce and Shopping, Consumer Goods, Consumer Electronics, Food and Beverage, and excludes Biotechnology, Financial Services, Privacy and Security, and Automotive. Note: The ranking is a snapshot in time.

(16) Includes the following industry groups: Biotechnology

(17) ADVANCE MONTHLY SALES FOR RETAIL AND FOOD SERVICES, APRIL 2020

(18) FemTech Fund — Portfolia Investing Funds for Women

(19) Diana Report Women Entrepreneurs 2014: Bridging the Gender Gap in Venture Capital

(20) CB Insights Stories: Healthcare AI In Numbers Q1'20 (subscription required to “view story”)

(21) CLIA Waiver by Application

(22) Principles for Codevelopment of an In Vitro Companion Diagnostic

(23) Smarter, More Accurate, and Less Expensive: How Artificial Intelligence is Revolutionizing Cancer Diagnosis

(24) WHO | Climate change and human health — risks and responses. Summary.

(25) Enabling Technologies for Personalized and Precision Medicine

(26) Frequently Asked Questions: Breakthrough Therapies

(27) First Round 10 Year Project

(28) The Rising Tide: A “Learning-By-Investing” Initiative to Bridge the Gender Gap